International factoringExport factoring

Japanese pageUntil recently Letter of credit (L/C) has been mostly accepted instrument to control international trade risk. Now more international trade settled by remittance without L/C , simply because of the demand for more simple and fast trade/settlement or the needs for less administration and financial burden on importer side.

![]()

International factoring is a simple alternative solution for exporter to collect money and secure account receivables, provided by the professional factors cooperating under the uniform service level agreement of FCI.*

- Secure export account receivables without L/C with 100% coverage.

- Strengthen buyer risk control.

- Simplify export administration and save time.

About export factoring

Mizuho factor provides credit protection against the importer’s inability to pay on open account terms,

underwrites the collection of invoices and 100% protection for non-payment by each invoice.

This service is to be originated in corporation with our correspondent import factor for each importer.

Benefits of export factoring

-

- Secure collection of export proceeds on open account terms

- Each invoice is managed by export and import factor until full payment.

Providing 100% protection for over-due invoice, 90 days or more from the due date.

-

- Creates business opportunity by using factoring

- Importer can purchases on convenient open account terms.

-

- Simplify export-related various administration

- Exporter can be released from the burden of administrative work from L/C or cash advance.

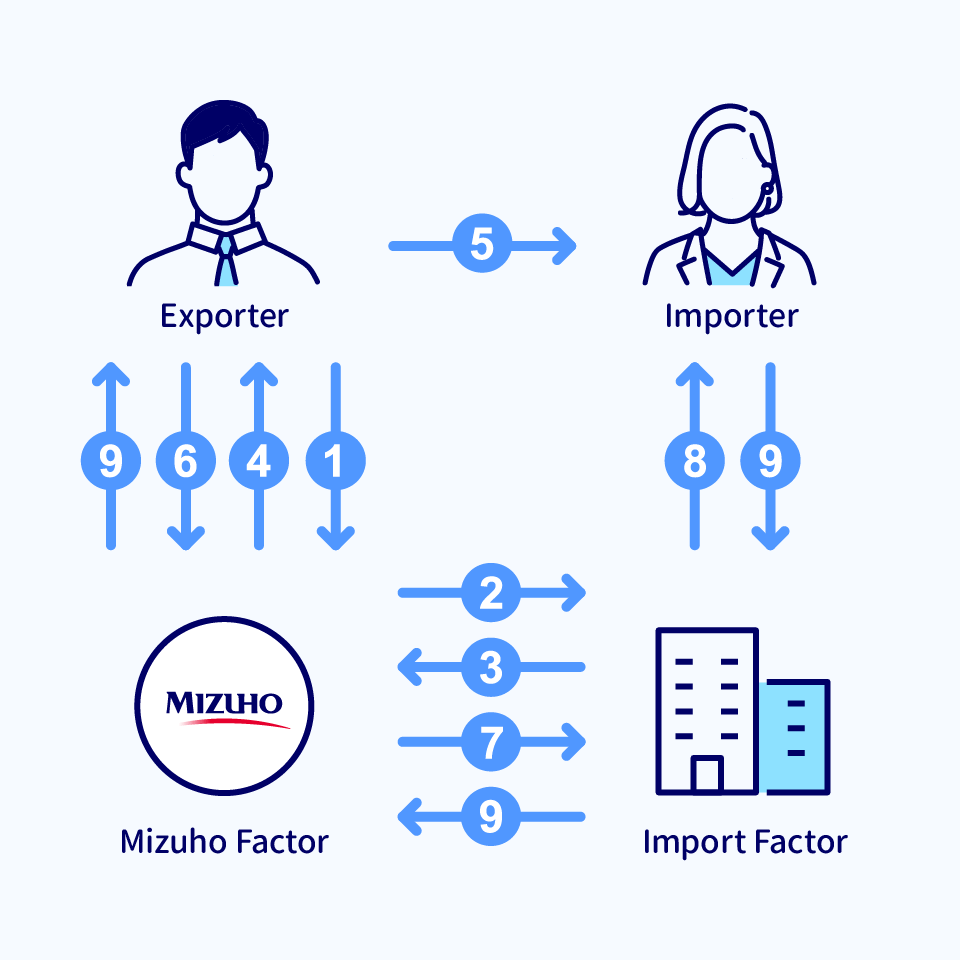

Scheme of export Factoring

-

- Credit Application

- Sending credit application for each importer to Mizuho Factor.

-

- Credit cover request

- Requesting credit assessment to import factor.

-

- Credit covers

- Approximately within 2 weeks result will be responded.

-

- Credit approval

- Notice of Credit Cover Limit to be issued with any applicable conditions.

-

- Shipment

- Shipment can be made based on agreed terms and conditions.

-

- Invoice copy etc.

- A copy of invoices and shipping documents must be sent to Mizuho Factor.

-

- Invoice details

- Mizuho factor sends the details of invoice to import factor.

-

- Collection

- Importer pays the proceeds to import factor on due date.

-

- Collection proceeds・Remittance・Payment

- Mizuho Factor will pay to exporter upon receipt of the funds from import factor.

Active cases

| Where to |

Industries | Incentives for exporter |

|---|---|---|

| Taiwan | Mfg of electric parts | Secure new importer risk |

| China | Mfg of chemicals | Shift from cash advance |

| USA | Mfg of maschines | Invoice discount to ease cashflow |

| Mfg of Beverage & Beers | Prompt collection and secure receivables |

Scroll sideways

Receivables from the proceeds of goods sales and services-rendered are acceptable.

Payment terms up to 120 days is normally accepted (maximum 180 days, exceptionally)

Trade contract including “acceptance inspection” clause may not be acceptable.

List of country for export factoring

- America

- United States, Canada, Chili, Brazil, Mexico

- Europe

- UK, Germany, France, Italy, Spain, Portugal, Nederland, Belgium, Luxembourg, Finland, Norway, Sweden, Denmark, Ireland, Switzerland, Austria, Poland, Czech, Slovakia, Hungary, Romania

- Asia

- Korea, Taiwan, China, Hong Kong, Singapore, Thailand, India, Vietnam, Indonesia, Philippines, Malaysia

- Oceania

- Australia, New Zealand

- Middle East and Africa

- Turkey, South Africa, UAE, Israel

The countries on this list are subject to change due to any possible events in financial environment. Please contact us for the details.

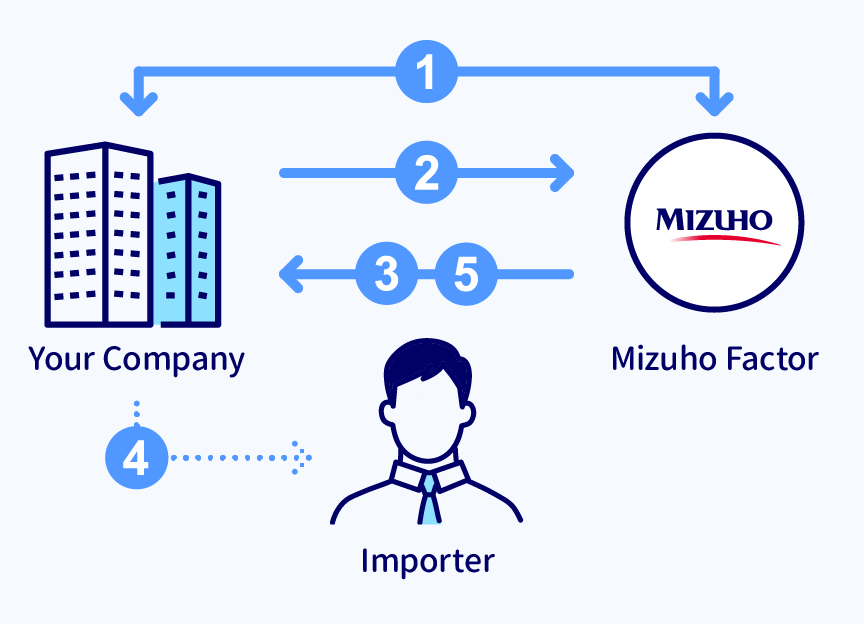

Flow chart to start up

-

- Export factoring Agreement

- Export factoring Agreement has to be signed. (Corporate Register and seal registration certificate required)

-

- Request for credit Line

- Sending credit application to us on each importer account respectively.

-

- Notice of Credit Cover Limit

- Notice of Credit Cover Limit to be issued with any applicable conditions.

-

- Introductory Letter

- Introductory letter needs to be sent to the importer from the exporter to notify the use of factoring.

-

- Finalizing factoring arrangement

- Factoring arrangement finalized and ready to use.